Helping SMBs sell globally and collect revenue locally

Small and medium-sized businesses (SMBs) often face the challenge of limited domestic markets that hinder their revenue potential. Nowadays, thanks to the advancement of international logistics, even the smallest businesses can have the opportunity to expand their reach globally. To successfully tap into new markets, SMBs require a global payment solution that aligns with their ambitions.

A significant hurdle for SMBs with international growth plans is achieving cashflow efficiency. Typically, when SMBs launch their e-commerce websites, they implement a payment gateway to facilitate global revenue collection. Although payment gateways are quick-to-market, they aren’t perfect, SMBs need to consider the following factors when implementing a payment gateway:

Merchant Discount Rate (MDR)

Payment gateways typically charge 1-3% MDR to e-commerce SMBs. Meaning the SMBs won’t receive the full revenue from their goods & services sold to customers

No real-time settlement

Payment gateways do not deliver the revenue to the SMBs’ bank accounts in real-time, the settlement cycle can rage from 1 – 7 days depending on the merchant’s location and settlement currencies

Potential dispute risks and costs

A chargeback happens when the cardholder contacts their card issuer to dispute a transaction. Once a chargeback process has begun, SMBs have little to no control, which is different from a refund process where it’s often left to the SMBs’ own discretion

Rolling reserve

A rolling reserve is a policy used by payment gateway providers to act as a safeguard against chargebacks. The payment gateway provider might ask for 10% of the SMBs’ monthly turnover to be set aside for a specific period, which might cause cash flow problems to SMBs

On the other hand, if SMBs opt for traditional banks, they would incur TT fees and foreign exchange fees each time they make payments to suppliers or collect revenue from overseas sales.

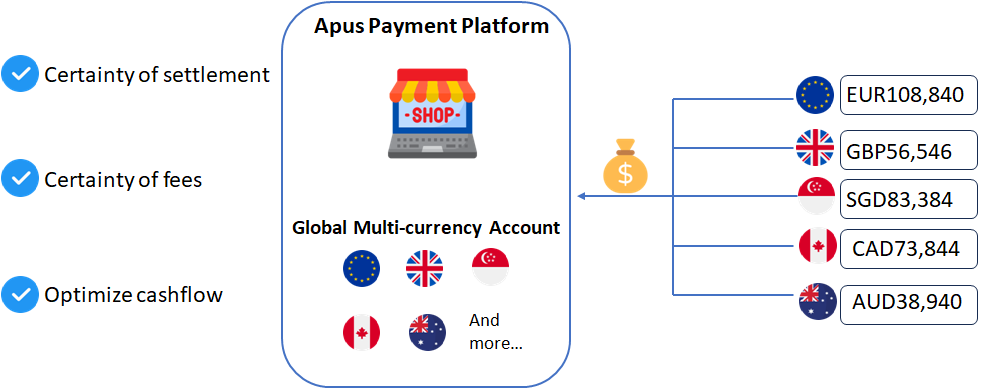

Apus Global Account solution addresses these challenges. With Apus, SMBs can collect funds locally in more than 20 currencies by leveraging Apus’ network of local accounts. This enables SMBs to receive payments from their customers through local banking rails, eliminating cross-border bank charges, payment delays, and foreign exchange markups imposed by banks. Moreover, SMBs can remit their overseas revenues back to their home country at a highly competitive conversion rate, giving them full control over cross-border payments and collections.

By utilizing the Apus Global Account solution, SMBs can streamline their international operations and overcome the collection and payment obstacles associated with expanding into new markets. With localized collection and payment capabilities and cost-effective conversion rates, SMBs can maximize their revenue potential and focus on their core business objectives, ensuring a smoother and more profitable global expansion.