The business world continues to become more digital and more global. Once exclusively the domain of major multinational companies, international trade is now becoming common for companies of all sizes. Technology has made it easier and more effective for more companies to pursue cross-border business opportunities. Even small to mid-sized businesses (SMBs) can now have global supply chains, work with foreign vendors, and sell to an international customer base.

In an ideal world, sending these payments would be simple, quick, and secure. As a growing number of companies are finding out, however, the cross-border payments process is often slow, complex, and full of friction. These pain points are more than just a nuisance, as nearly nine in ten finance professionals reported that the complexities in cross-border collections and payouts hinder their businesses’ ability to grow globally.

The Pain Points of SMB and Startup Payment

Business Account

Heavy documentation, manual process, long waiting time to open a business account with traditional banks

Restricted account functionality and limited jurisdictional coverage become a bottleneck to source revenue globally

Operations

Cross-border payments still rely on traditional banking rails, which are costly, slow, and lack transparency

SMBs and Startups find themselves lost between retail and corporate banking segments, unable to obtain relevant customer service when needed

Scalability

Rigid banking infrastructure is extremely difficult to integrate with corporate management tools, such as AR/AP systems, expense management, etc.

SMBs and Startups don’t have the luxury of a big budget to do back-office integration with each banking partner in different locations

Security

SMBs and Startup B2B payments are prone to fraud, both internally and externally

Traditional Internet banking has limited functionality for internal workflow and approval matrix customization

How it Works

With more companies operating across international borders, business-to-business (B2B) payments are an increasingly important

aspect. Companies with global operations need to regularly send and receive payments internationally at a more efficient speed and lower costs.

Apus Technology provides a borderless payment solution helping SMBs and Startups to connect with the world economy and enjoy the benefits of global expansion.

Apus Web Portal

Process your payments and collections directly from Apus Web Portal, no integration required

Full API Integration

A seamless and straight-through-processing (STP) that can be integrated with your back-office applications

Rate Checker

Digital Onboarding

SMB and Startup-friendly digital onboarding, fully remote

Secured

Additional security layer, such as workflow management and payment control, to prevent fraud

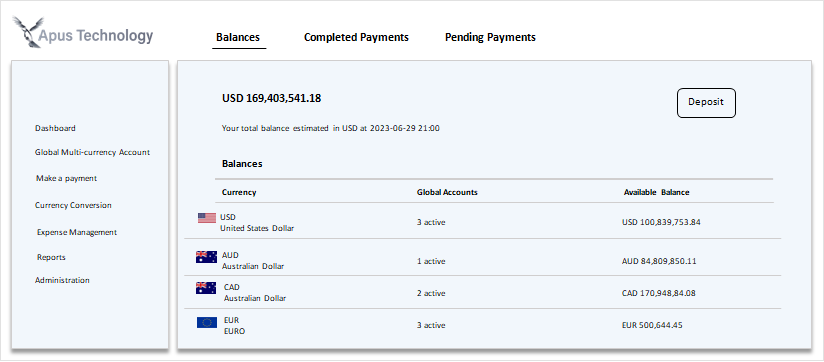

Multi-currency account

Multi-currency account: one-click to create an account and hold up to 20 currencies, with local collection and pay-out options to unlock revenue sources globally

Faster Payment

Same-day payments (single or batch) for selected currencies at low costs to accelerate cash flow

API-native

API-native and interoperable with back-office applications, such as expense management, AR/AP systems

Competitive FX

Competitive FX rates: real-time FX rates close to the mid-market rate