International Payments

Faster, cheaper, safer

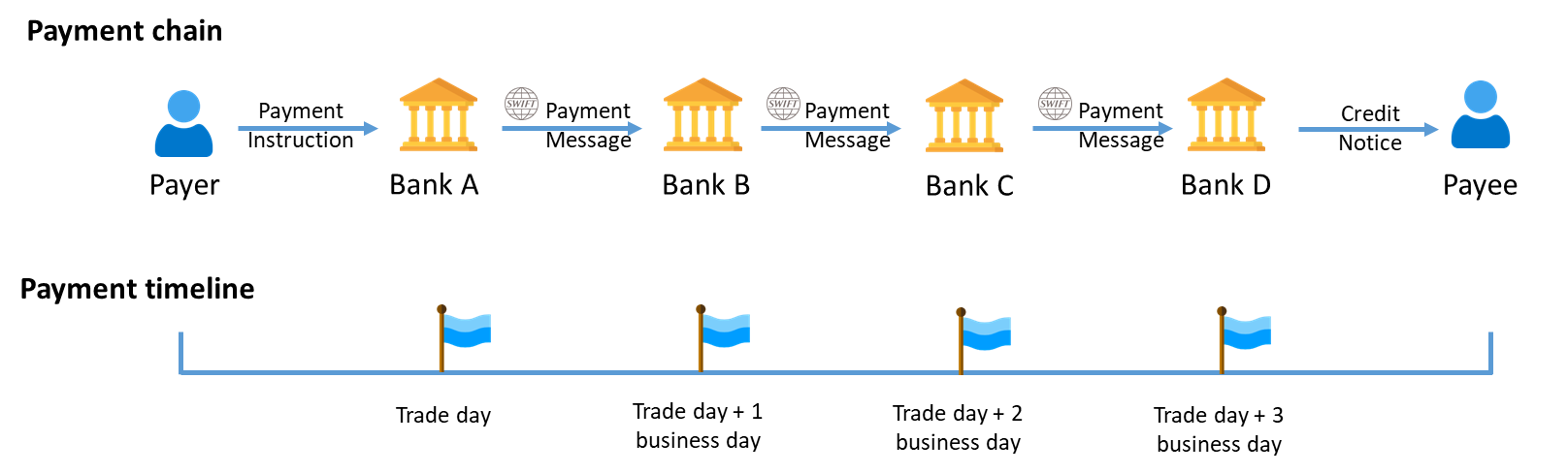

In traditional financial services, correspondent banking networks are the foundation of modern international payments; in essence, it’s a long payment chain to realize a cross-border payment from one country to another, when money leaves the Payer’s bank account, it is passed from one bank to another in the payment chain, until it arrives at the Payee’s bank account. Along this payment chain until it arrives, the payment could encounter various hiccups, including but not limited to:

- Bank holidays in an intermediary bank’s country, causing the payment stuck at the intermediary bank.

- Banks along the payment chain inevitably take charges from the payment principal amount, when Payee receives the money, it’s much lesser than he/she is expecting, causing confusion in reconciliation.

- Expensive foreign exchange rates imposed by banks left Payer and Payee no negotiation power.

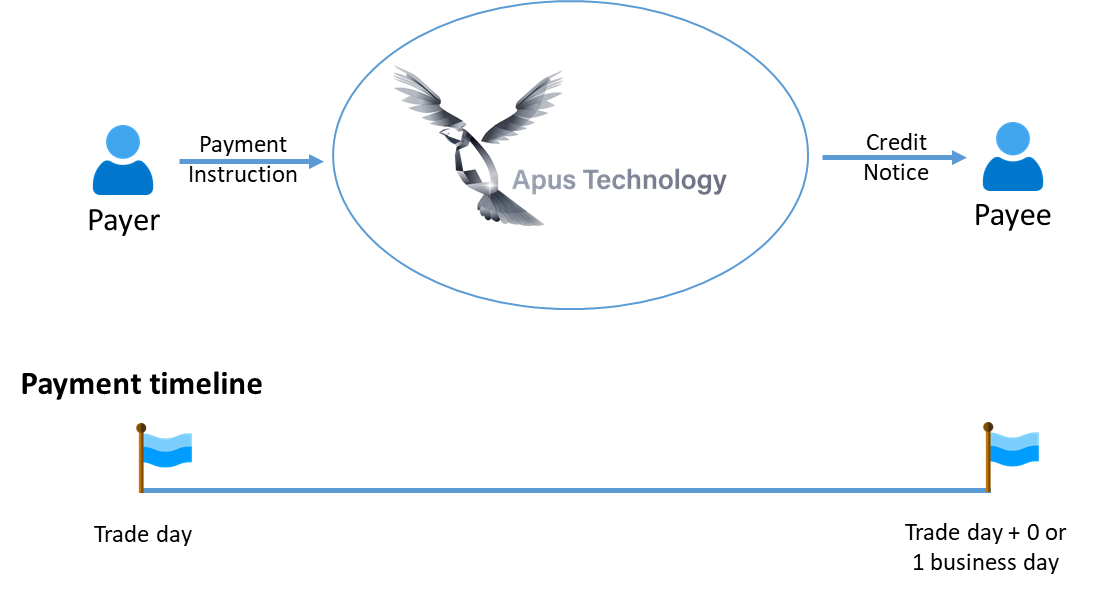

Apus International Payments solution allows you to take full advantage of our in-country local accounts to make and receive payments locally, cutting across the long payment chain of traditional correspondent banking networks.

In Apus Payment Platform

Same day or next day payment

Same day or next day payment Transparent foreign exchange rate and possible to lock a rate for a future payment

Transparent foreign exchange rate and possible to lock a rate for a future payment Zero international wire charges

Zero international wire charges Guaranteed full payment amount

Guaranteed full payment amount