Making professional services borderless

The professional services industry has gained significant prominence thanks to advancements in technology. These specialized remote teams offer vital expertise to businesses focused on hyper-growth.

According to Wrike’s 2019 “Professional Services Work Benchmark” report, 17% of surveyed firms identified “confusing billing or activity tracking” as the leading cause of customer churn. Billing plays a crucial role in any business as it ensures payment for the work performed on behalf of customers and customers. However, the billing process is often complex and time-consuming, leading to inefficiencies.

To cater to international customers, many professional services firms have adopted payment gateways for collecting global revenue. While most payment gateways are connected to multiple card networks such as Visa®, Mastercard®, American Express®, Discover®, China UnionPay®, and JCB®, they often offer a one-size-fits-all solution. However, not every professional services firm bill customer in the same way.

For example, a marketing firm is likely to have a different billing structure than a legal services organization or an architecture firm due to the unique nature of its work. Some professional services firms are more at risk of experiencing chargebacks than others. The software industry – at 0.66% – has the highest chargeback ratio. This can potentially be attributed to the fact that software is typically sold on a subscription basis (SaaS, or Software-as-a-Service). Their business model relies on charging people on a recurring monthly cycle. When free trial turns into monthly recurring costs to their customers, customers may be less willing to pay for the subscription and request for a chargeback accordingly. If the number of chargebacks professional services firms encounter meets a certain threshold, they could face penalties either in the form of higher fees or may even lose their payment gateway provider. If the latter happens, the business may be considered high-risk and will need to find a new payment gateway provider who is willing to take on a high-risk profile.

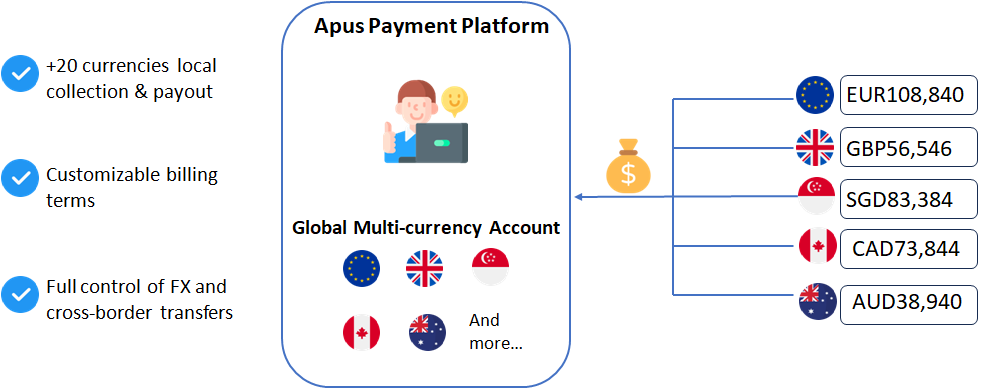

Introducing the Apus Payment Platform, designed to meet the needs of modern professional services leaders. With customizable payment solutions, professional services firms can open a Global Account to receive payments in local currencies, avoiding cross-border payment charges and hidden foreign exchange markups. Additionally, firms can create and send recurring payment links and automate payment reminders for ongoing services, streamlining the billing process.

The Apus Payment Platform empowers professional services firms to adapt their payment methods to suit their specific requirements, ensuring efficient and seamless transactions. By simplifying the billing process and providing customizable solutions, Apus enables these firms to focus on delivering exceptional services while maintaining a smooth and transparent payment experience for their customers.